This World Financial Planning Day, FPSB and its global network of organizations will host a variety of events and activities to help individuals realize the wide-ranging benefits of financial planning.

Welcome to World Financial Planning Day

Hear from CFP professionals around the world on how financial planning can help you achieve life goals.

Research on the Value of Financial Planning

Learn about the benefits of financial planning and the value of working with a financial planner from a global consumer study commissioned by FPSB.

IOSCO support of World Financial Planning Day

Hear from IOSCO Secretary General Rodrigo Buenaventura on how financial planning can help make more informed investors.

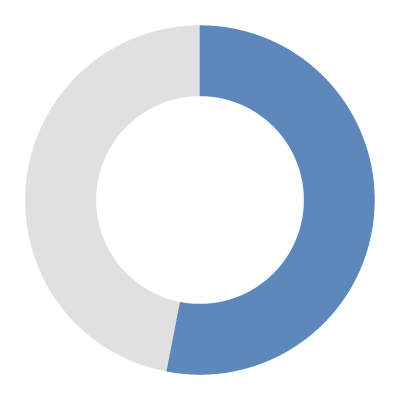

FPSB® Value of Financial Planning Index ™ measures the impact of financial planning on the lives of clients, with scores ranging from 0 to 100.

Find a CFP Professional

Experience a higher quality of life:

Greater financial confidence:

More satisfied with their financial situation:

Better experience with the financial planning process:

A financial plan can help you take control of your finances and achieve your goals.

Improved financial wellbeing and peace of mind

Better financial decision-making confidence

Feel more satisfied with their wealth

Help to explain and simplify financial matters

Saves time and effort organizing finances

Better off in many aspects of life…

A global consumer study commissioned by FPSB and conducted by an independent research firm found that people who work with a professional financial planner are better off in many aspects of their life.

79% agree financial planning helps fulfill dreams

73% feel they cope better when faced with health issues

51% say financial planning positively impacted their family life

51% report financial planning positively impacted their mental health

Financial planning for the next generation

Gen Y are proving to be highly engaged with their finances and are open to the value financial planning can bring, according to a global consumer study commissioned by FPSB and conducted by an independent research firm.

53% have or expect to come into an inheritance or major financial support in coming years

62% likely to start receiving this within the next 10 years, with 80% estimating this to be above US$50K

67% of unadvised Gen Y would consider paying for financial advice

34% have never engaged with a financial planner but would consider it, with 50% of those looking to start within the next 3 years, and 85% within the next 10 years

Happenings

About World Financial Planning Day

Each year, the global financial planning profession will comes together for World Financial Planning Day to help raise awareness of the value of financial planning, having a financial plan, and working with a financial planner who has committed to standards of competency and ethics and putting clients’ interests first.

Explore this site to learn more, and visit an FPSB Affiliate near you to discover how a CERTIFIED FINANCIAL PLANNER professional can help you live your today and plan your tomorrow.

Read press release.

About World Investor Week

World Financial Planning Day is a part of World Investor Week and is sponsored by the International Organization of Securities Commissions. WIW raises awareness about the importance of investor education and protection.

Learn more about World Investor Week global events.

Read press release.

Global Financial Planning Community to Celebrate 9th World Financial Planning Day on 8 October

DENVER, COLO – 1 October 2025 – With 79% of consumers reporting that financial planning helps fulfill life dreams, the Financial Planning Standards Board Ltd. (FPSB) and its global network across 28 territories will host the 9th World Financial Planning Day on 8 October 2025. The annual event demonstrates how financial planning – and working with a financial planner who has committed to competency and ethical standards – helps people worldwide achieve greater financial well-being

About Financial Planning Standards Board Ltd.

Financial Planning Standards Board Ltd. (FPSB) establishes, upholds and promotes worldwide professional standards for financial planning to foster public confidence in the profession. FPSB demonstrates its commitment to excellence through its ownership of the international CERTIFIED FINANCIAL PLANNER certification program outside the United States.

The FPSB global network consists of organizations in 28 territories that offer, or are preparing to offer, CERTIFIED FINANCIAL PLANNER certification, the most desired and respected global credential for those seeking to demonstrate their commitment to competent and ethical financial planning practice. At the end of 2024, there were 230,648 CFP professionals worldwide.

Learn more about us at FPSB.org, or find the FPSB affiliate organization in your country or territory.

Ready to Learn How Financial Planning Can Help You?

With more than 230,000 CERTIFIED FINANCIAL PLANNER professionals worldwide, it’s easy to find your match. Visit the FPSB affiliate organization in your country or territory to find a competent and ethical CFP professional near you.

Follow the Global Conversation for #WFPD2025

There’s great power in sports, and the more we get together to play, the merrier we are.📷📷📷

This is Year 3!!! The game goes on and we are happy to welcome you once again. 📷

#WalkingFootball #WFPD2025 #ParkinsonsAfrica #ADPForg #ParkinsonsAwareness #ParkinsonsDisease

Indeed, Parkinson’s may slow down movement, but it will never stop passion!

Let’s celebrate our first-time tournament participants! 📷📷📷

#WalkingFootball #WFPD2025 #Champions #ParkinsonsAfrica #ADPForg #ParkinsonsAwareness #ParkinsonsDisease

Thank you @lesenergyserv for showing what #EnergyinMotion looks like. 📷📷📷📷📷📷📷

We can’t wait to have you on the field 📷

#WalkingFootball #WFPD2025 #LESEnergy #ParkinsonsAfrica #ADPForg #ParkinsonsAwareness #ParkinsonsDisease